Investing in distressed properties can be an excellent way to build wealth, create value, and enjoy a high return on investment (ROI). However, the process requires a keen eye for potential, an understanding of market dynamics, and a strategic approach to renovations. Here are essential tips to help you identify, purchase, and renovate distressed properties for maximum returns.

1. Identifying the Right Property

Research Market Demand

Before jumping into any distressed property, it’s essential to understand the local real estate market. Look for areas with rising home values, high rental demand, and strong job markets. These factors often indicate a stable or growing market where property values are likely to increase. Research neighborhoods with high potential for appreciation and assess if they meet your investment criteria.

Look for the Right Types of Distressed Properties

Distressed properties come in various forms: foreclosures, short sales, and REOs (real estate-owned properties) are some of the most common. Each type offers unique advantages and challenges. Foreclosures and REOs, for instance, may have liens or legal complications but can often be purchased below market value. On the other hand, properties in pre-foreclosure or short sale situations can be negotiated directly with the seller, potentially allowing more favorable terms.

Identify Key Red Flags

While distressed properties are typically in need of repair, some red flags can signal more extensive, costly issues. Be cautious of significant foundation problems, severe water damage, or major electrical or plumbing issues, as these can quickly escalate costs. While manageable with the right team, these issues should be considered carefully in relation to the property’s potential ROI.

2. Purchasing Tips

Work with Experienced Professionals

Distressed properties require a knowledgeable team to ensure a smooth purchase process. Work with a real estate agent experienced in distressed property transactions and local regulations, along with a real estate attorney if necessary, to navigate title searches, liens, and any potential legal complications.

Understand Financing Options

Financing distressed properties can be different than traditional real estate purchases. Many buyers rely on hard money loans, cash purchases, or renovation loans like the FHA 203(k) loan. Understand the terms and timelines associated with each option to find what best suits your investment plan. Quick access to capital can make or break a deal, especially with properties that attract high investor interest.

Negotiate with ROI in Mind

Negotiation is critical in maximizing your ROI. Don’t just look at the initial purchase price—factor in estimated repair costs and future resale value to determine a fair offer. Consider negotiating for a lower price by citing needed repairs or making an all-cash offer for a quicker closing. This approach can often convince the seller to accept a lower offer for the benefit of a smooth, fast sale.

3. Renovating for Maximum ROI

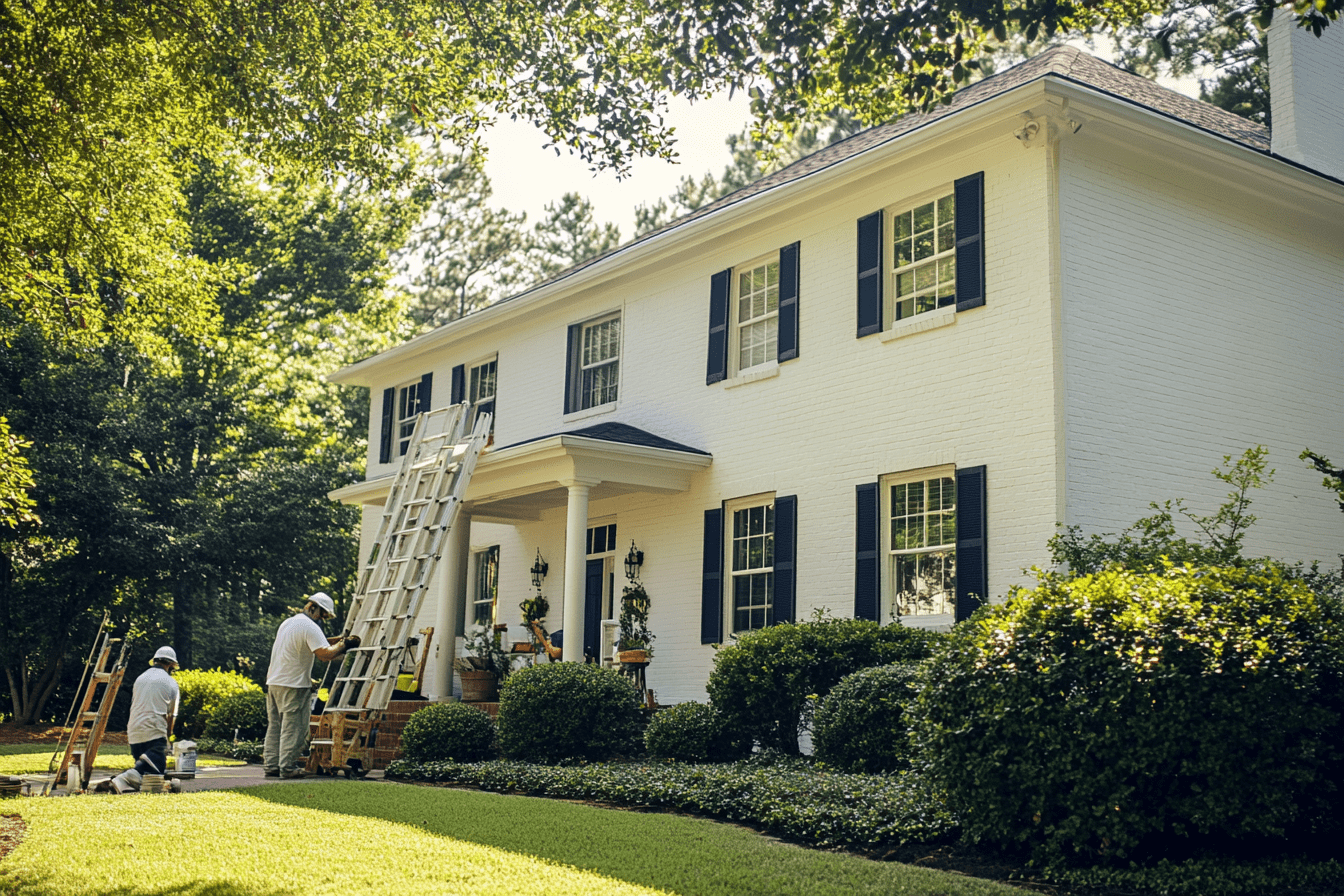

Prioritize High-Impact Renovations

For maximum ROI, prioritize renovations that add the most value. Kitchen and bathroom remodels tend to offer a solid return, as they appeal directly to buyers and renters alike. Additionally, consider improvements to curb appeal, such as landscaping, new paint, or updated exterior fixtures. These relatively inexpensive upgrades can significantly enhance the property’s appeal and increase its market value.

Maintain a Budget and Timeline

Staying on budget and on time is crucial for a successful fix-and-flip. Before beginning renovations, create a detailed budget that accounts for labor, materials, permits, and contingencies (typically 10-15% of the renovation budget). Keep a realistic timeline, as holding onto the property too long will cut into profits with carrying costs like property taxes, insurance, and utilities.

Consider Energy-Efficient Upgrades

In today’s market, energy-efficient homes have a competitive edge. Consider adding upgrades like energy-efficient windows, smart thermostats, or improved insulation. While these upgrades may come at an additional cost, they can attract eco-conscious buyers and lead to higher resale value or rental rates.

Hire Skilled, Reliable Contractors

Finding the right contractor is crucial to a successful renovation. Take the time to vet contractors thoroughly, checking references and previous work. Clear communication is essential—ensure your contractor understands your goals, timeline, and budget. Regularly check on progress to keep the project on track and address issues as they arise.

4. Selling or Renting Out the Property

Staging and Marketing for Resale

Once renovations are complete, focus on staging the property for maximum appeal. Well-staged homes often sell faster and for a higher price, as buyers can more easily envision living in the space. Invest in professional photography and market the property through multiple channels to reach the widest audience.

Evaluate Rental Income Potential

If you plan to rent out the property instead of selling, evaluate its rental income potential by comparing similar properties in the area. Short-term rentals can be highly profitable in tourist-heavy markets, while long-term rentals provide consistent income. Consider which approach best suits your investment strategy and adjust renovations accordingly to appeal to prospective tenants.

Final Thoughts

Distressed properties present incredible opportunities, but they require careful planning and execution to unlock their full potential. By following these tips on identifying, purchasing, and renovating properties, you can make informed decisions and set yourself up for a high return on investment. Remember that each property is unique, so stay flexible and adapt your approach as needed. With the right strategy, distressed property investments can be a lucrative addition to your real estate portfolio.